In the modern era of piping systems, the GRP (Glass Reinforced Plastic) pipe family surpasses their traditional alternatives, such as steel or PVC. GRP pipes are able to handle aggressive fluids in hard-to-access locations where lightweight and corrosion-free pipelines are required. Engineers and contractors select GRP pipes in irrigation, oil and gas, and water infrastructure. The Middle East & Africa account for around 7% of the global share, primarily used in oil and gas plants.

Let’s see how GRP piping systems saved the market through their magnificent properties. This article includes a deep look into the global market, its segmentations, main market drivers, the competitive landscape, and the latest trends.

Global Market Overview: The Case of Glass Reinforced Plastic Pipes

The GRP pipe market has achieved significant growth in the last decade, and it is expected to continue rising as piping system technologies develop.

What Is the Market Size of GRP Pipes? The Current Stage and Future Forecast

The global GRP pipe market, which was valued at around USD 6.38 billion in 2024, is forecasted to reach USD 8.85 billion by 2031 with a CAGR of 4.6%. This growth shows how contractors are coming into plastic composite pipes due to their magnificent function in harsh environments.

Growth Rate (CAGR) of GRP Pipes

What is CAGR? The CAGR (Compound Annual Growth Rate) of each industry represents how it grows annually as the investment increases or decreases over time.

The market of GRP pipes is expected to reach moderate growth in this demanding decade, with a CAGR of 4.6% in 2031, as GRP pipes turn into the top choices for water infrastructure, the energy sector, and industrial use cases.

What Market Trends Are Leading the Growth of the GRP Pipe Market?

Based on the latest trends of piping systems, piping systems request sustainable and eco-friendly materials that require less maintenance and cause less harm to the environment than traditional pipes, such as steel, concrete, or PVC pipes.

For instance, Fortune Business Insights highlights that in the Asia-Pacific region, which includes about 45% of the global share in 2024. In emerging economies, where outdated infrastructures require more resistant pipelines like GRP pipes with an over 50-year lifespan.

- GRP pipes have a low environmental impact.

- Urbanization drives demand for durable pipes.

- GRP pipes resist corrosion and need less maintenance.

- Water scarcity increases GRP use in irrigation.

- GRP pipes are ideal for harsh environments.

That’s why GRP pipes are getting the highest share of pipes in various piping choices.

Market Drivers and Restraints

The GRP pipe market contains such drivers and challenges that have shaped the adaptation, growth, or failure of the market in recent years.

Growth Drivers

When it comes to the main forces in GRP growth, the evolution of urbanization and replacement of old infrastructure is what can handle the most significant share among all piping systems. These systems usually require a pipeline able to withstand conditions below:

- Corrosion

- Chemicals

- High pressure

- Thermal changes

That’s where GRP pipes can be helpful with minimal maintenance needs. Also, in irrigation and water treatment projects, GRP pipes surpassed alternatives with a longer lifespan.

Market Restraints

Just like all markets, GRP pipes face dilemmas such as high production, high initial, and installation costs, which can be removed from the pipe selection. As a matter of fact, GRP pipes last longer than their alternatives, which reduces the overall costs.

Moreover, some others may argue that the lack of awareness and resistance to changing the old image of piping materials (steel, concrete, or PVC) discourages contractors from selecting GRP pipes for their projects.

GRP Pipe Market Segmentation

GRP pipes are segmented by application, resin type, and end-use industries, which are included in such categories that shape the share of each type.

By Application

GRP pipes are used in several applications due to their flexible characteristics, jointing methods, and installation processes. The most significant share can be different in a global or regional view:

- Water Infrastructures: GRP pipes are widely used in water supply and transmission as they don’t corrode, preventing any threat to drinking water.

- Wastewater And Sewer Systems: The biogenic corrosion is a special case of sewer that GRP pipes with their perfect resin layers are resistant, while lasting over decades with no corrosion included.

- Irrigation Networks: In sites where water is scarce or a lack of pumping energy requires such affordable pipelines, GRP pipes with their smooth inner surface come to the game.

- Oil & Gas Pipelines: In offshore and aggressive environments, where thermal stability and resistance to high-pressure flows are required, GRP pipes are the top choice in modern solutions. (Source: Scribd)

- Industrial Application: The power plants, like cooling water or fluid transportations that are treated with harsh chemicals, need such resistance to corrosion as GRP pipes contain.

- Desalination & Chemical Processing: A big share of GRP pipe usage in the GCC, especially in Saudi Arabia and the UAE, is for desalination plants.

By Resin Type

The resin type used in GRP pipes includes three main ones: unsaturated polyester, vinyl ester, and epoxy resin matrix, each of which provide pipes with specific usage:

- Polyester: The most common one, for more moderate use cases like water supply and sewer systems.

- Vinyl ester: A superior corrosion and chemical resistance in chemical processing and desalination plants.

- Epoxy: Used for more intensive applications like oil and gas pipelines, where temperature tolerance matters the most.

Check the table below to figure out what type of GRP pipe is used in each application:

| Category | Applications | Resin Types | End-Use Industries |

|---|---|---|---|

| Water Transmission & Distribution | Used for carrying drinking water due to corrosion resistance | Polyester | Municipal: Water supply and sewage systems |

| Wastewater & Sewage Systems | Ideal for long-term durability in wastewater and sewage systems | Epoxy: Enhanced chemical resistance | Municipal: Wastewater management |

| Irrigation | Increasing demand in water-scarce regions for efficient systems | Polyester, Vinyl Ester | Agriculture: Irrigation systems |

| Oil & Gas Pipelines | Preferred in offshore and corrosive environments | Vinyl Ester | Energy: Oil and gas pipelines |

| Industrial & Power Utilities | Used for fluid transportation and cooling water in plants | Polyester, Vinyl Ester | Industrial: Fluid transport and cooling systems |

| Desalination & Chemical Processing | Ideal for chemical resistance and seawater applications | Vinyl Ester | Chemical Processing, Energy: Desalination plants |

How The Market of GRP Pipes Divided by Regions?

The GRP pipe market is also segmented by several popular regions that include the biggest share of GRP pipe usage in multiple use cases. The Asia-Pacific is the biggest one, and MEA shows the strongest growth over the past years. Check how each of these regions utilizes GRP pipes for their infrastructures.

Asia-Pacific

With almost 45% of global market share, Asia-Pacific and more specifically China and India, are experiencing such an increase in demand for GRP pipes in irrigation and water supply due to the urbanization of local areas.

Furthermore, as the second stage, in Japan and South Korea, GRP pipes are used for municipal water and industrial applications like chemical processing.

Middle East & Africa (MEA)

The case of the Middle East and Africa represented a fast growth in the GRP market. As the GCC (Gulf Cooperation Council) notably takes place for their desalination plants and oil & gas pipelines, mostly in Saudi Arabia and the UAE.

This region is expected to reach USD 152.5 million by 2030 if the investments in eco-friendly and durable pipelines dedicated to GRP pipes are made.

The case of North America, Europe, and Latin America

In North America, the U.S., and in Europe, Germany is one of the main countries that chose GRP pipes for their piping projects. In the U.S., they’re used for water and sewage systems, while in Germany, the focus is on sustainability in wastewater and gas pipelines.

Also, in Latin America, the smallest share is included, but this one also seems likely to grow in irrigation lines and water treatments of Brazil and Argentina.

The Competitive Landscape of The GRP Pipe Market

This section will guide you to achieve an overview of the most famous leaders in GRP piping, the recent functional strategies, and their footprint and consequences.

What Are the World Leaders of the GRP Pipe Market?

The GRP pipe market is indicated by its leaders, who own the biggest share among their regional competitors. Future Pipe Industries (UAE), Amiblu Holding GmbH (Austria), and Saudi Arabian Amiantit Co. (Saudi Arabia) are some worldwide examples of these leaders, and below are other most-heard manufacturers:

- Aliaxis

- Kinflare Group

- Ashirvad Pipes

- Sri Lakshmi Fibres

- WIG Wietersdorfer Holding GmbH

- Graphite India Ltd.

- Hengrun Group Co., Ltd.

How Do These Leaders Develop the Market with Their Strategies

Amiblu’s recent strategic move to buy RPC Pipe Systems has helped the company grow in the Asia-Pacific region. Future Pipe Industries has also been investing money in new GRP technology and growing its business around the world, especially in the GCC area.

Regional Manufacturing and Distribution Footprint

To better serve important markets, manufacturing and distribution networks are becoming more localized.

Businesses are building new factories in the GCC and Asia-Pacific to make sure they can deliver goods faster and meet regional content needs. This growth makes supply chains work better and lets big infrastructure projects get done faster.

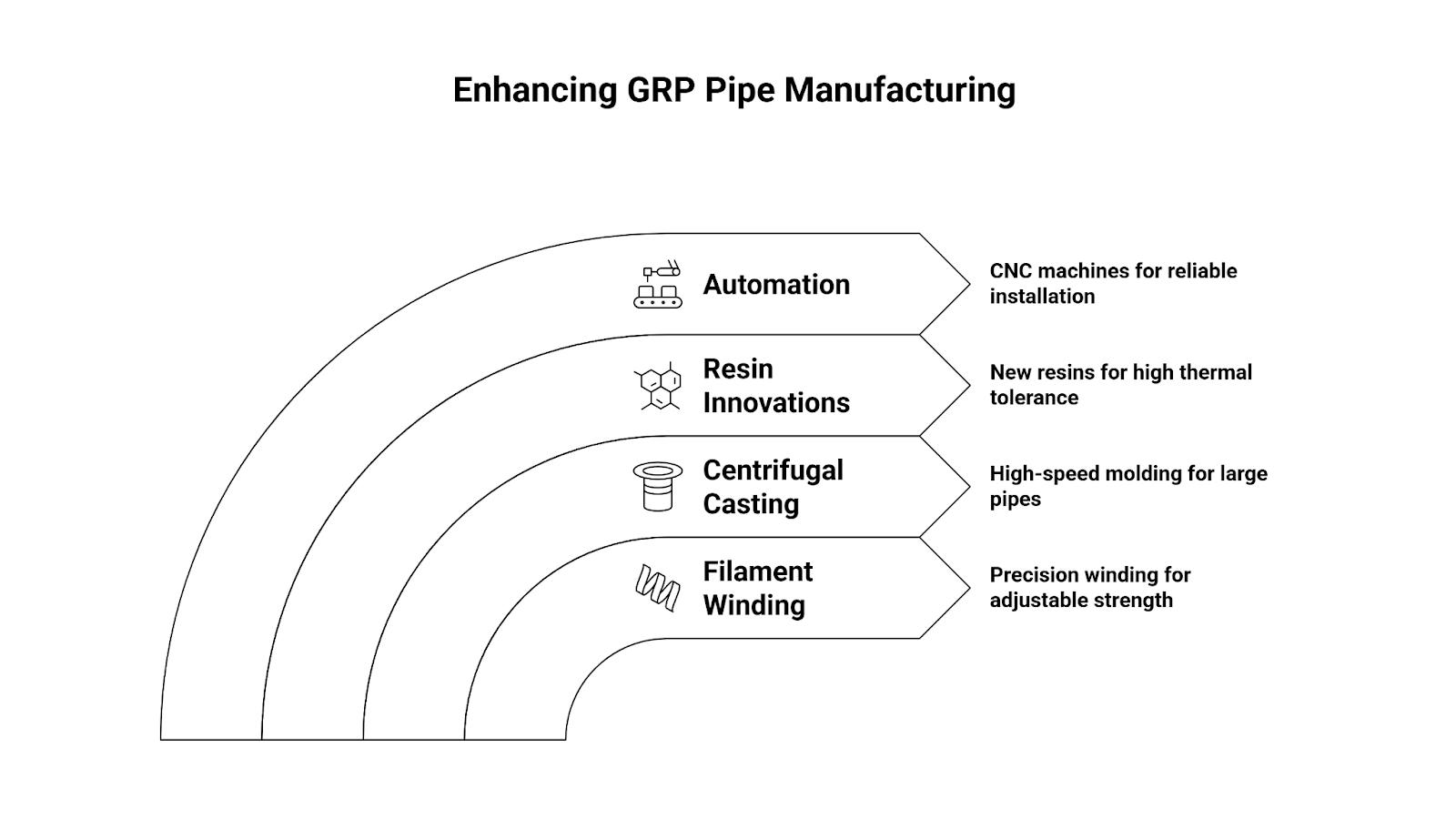

Latest Innovations in The Manufacturing Process

Recent improvements in the manufacturing process of GRP pipes have eased the process and minimized both initial and overall costs.

- Filament Winding: Winding glass fibers and resin around a mandrel to shape the pipes flawlessly, so that the orientation design is adjustable to add strength.

- Centrifugal Casting: A high-speed mold is used to compact materials into pipes of large diameters and for high-pressure systems.

- Resin Innovations: There are some new types of resin and additives that have raised the thermal tolerance up to 1000 degrees. (Source: Future Pipe)

- Automation: CNC machine eases the process of pipe cutting and manufacturing for a reliable installation with no leakage included.

Cost Breakdown (Materials, Labor, Equipment)

Despite the low overall cost of GRP pipes, they contain a higher initial cost (for materials: resin and glass fibers) and installation or equipment of the production.

GRP vs Steel and PVC: A Case of Lifespan Comparison

GRP pipes include a lower cost for the lifecycle compared to steel or PVC, which may crack under harsh conditions. Also, they require less maintenance or repair.

Regional Pricing Drivers

The pricing of GRP pipe depends on the region’s price ranges. These ranges come from material availability, labor costs, and logistics effectiveness.

Future Outlook of GRP Pipe Market

Specific applications such as hydrogen transport, CO2 pipelines, and smart water supplies become the future of GRP piping systems. Regions like Asia-Pacific and MEA are experiencing such quick growth in energy transmission sectors. Stakeholders should invest in resin innovation, digital monitoring, and regional production to stay ahead.

about

The Author

Farshid Tavakoli is a seasoned professional in engineering and international trade. Holding degrees in Electrical Engineering, Mechatronics, and a Doctorate in Business Administration (DBA) from the University of Lyon, he also has a strong background in industrial automation and production line technologies.

For over 17 years, he has led an international trading company, gaining deep expertise in commercial solutions tailored to industrial needs. With more than 8 years of active involvement in infrastructure development, he specializes in the supply of electromechanical equipment for water and wastewater treatment plants and transfer projects.

Together with comapny expert team, he now provides consultancy and integrated solutions for sourcing and implementing complex infrastructure projects across the region.